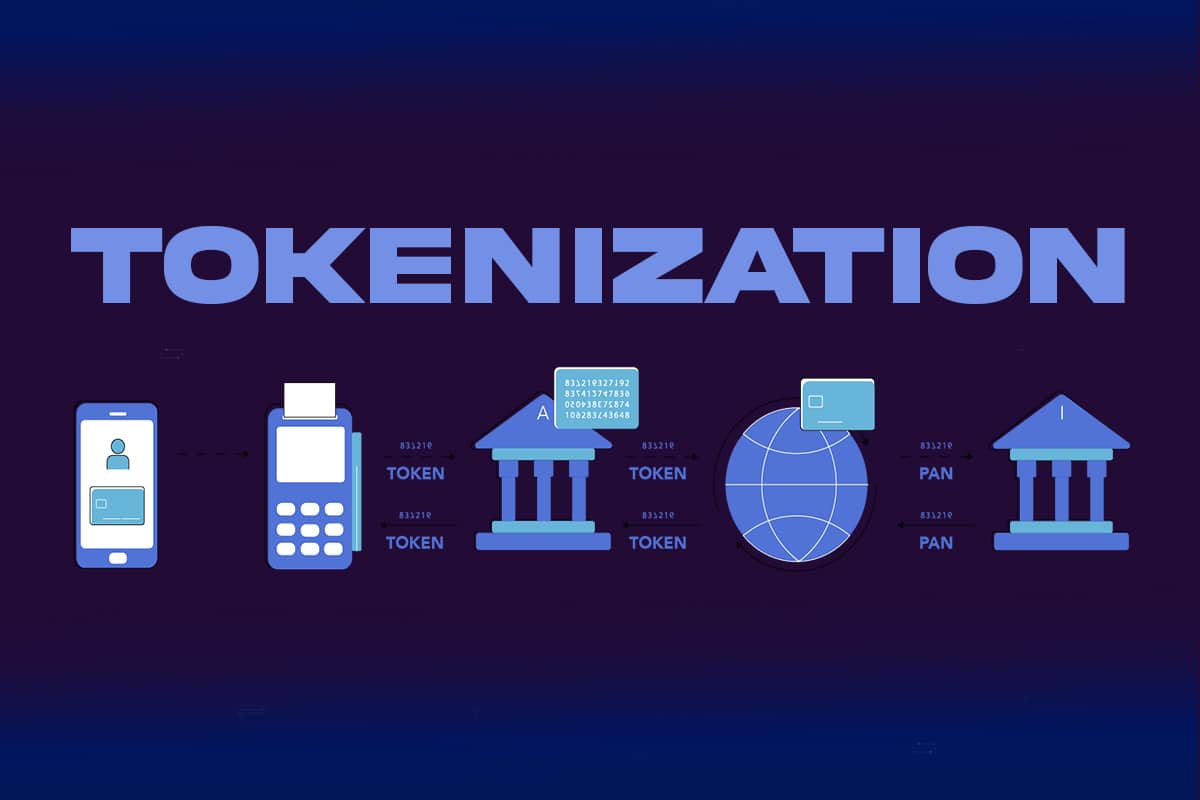

Tokenization is fundamentally shifting access to investment opportunities. By enabling fractional ownership of high-value assets—think real estate, private equity, or even fine art—tokenization makes previously exclusive investments accessible to everyday people. Tokenized assets are digital representations on a blockchain, dividing ownership into fractions that can be bought and sold. This removes the traditional high capital barrier, allowing anyone with even modest funds to participate.

Accessibility and Fractional Ownership

In traditional markets, asset ownership often requires substantial initial capital. This structure inherently benefits the wealthy and institutional investors, excluding most middle-class individuals. With tokenization, anyone can invest in, say, 1% of a luxury property instead of needing millions to buy it outright. This shift towards fractional ownership is already leveling the playing field, giving average investors the ability to build wealth through assets that historically favored only the elite.

The Liquidity Revolution

Liquidity has long been a hurdle in traditional asset classes, especially in real estate or private equity. These assets require months, if not years, to buy or sell. With tokenization, liquidity is inherently enhanced, as tokenized assets can be traded more easily on blockchain-based exchanges. Investors no longer need to wait for an opportune buyer or pay exorbitant broker fees; they can buy and sell fractions as needed, creating a more flexible financial ecosystem.

Regulatory Hurdles and Restricted Access

The U.S. regulatory framework, particularly the Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA) guidelines, impose significant restrictions on tokenized assets. These frameworks often classify tokenized assets as securities, meaning issuers must adhere to strict compliance measures, including investor accreditation and reporting. For example, Regulation D, commonly used in commercial real estate offerings, limits participation to accredited investors—those with over $1 million in net worth or high annual incomes. This requirement excludes middle America from many investment opportunities.

Regulation Crowdfunding (Reg C), Regulation A, and Regulation A+ are opening new pathways for ordinary investors to access previously off-limits opportunities.

Reg C allows small companies to raise up to $5 million from everyday investors via online platforms, empowering local businesses and startups to tap into community-based funding. Reg A and Reg A+, on the other hand, provide mid-sized and larger companies with a framework to raise up to $20 million and $75 million respectively, offering non-accredited investors a chance to invest in vetted, but early-stage, growth opportunities.

These frameworks are especially beneficial in tokenization, where digital assets can represent fractional ownership in real-world assets like real estate or fine art, enabling a wider array of investors to participate.

However, these regulations have their downsides.

They still require substantial legal, accounting, and filing costs, which can deter smaller companies from pursuing tokenized offerings. And, while these regulations lower the barriers to entry for investors, they often come with restrictions on resale, limiting the liquidity that’s so vital for tokenized markets to thrive.

Another restrictive regulation is Regulation S, which governs offerings made outside the U.S., yet limits American investors’ access, further constraining the investor pool and impacting the liquidity of these assets. By restricting investor participation, these frameworks hinder the very liquidity and democratization that tokenization promises.

A Double-Edged Sword: Red Tape vs. Financial Inclusion

While regulations are intended to protect investors, they disproportionately exclude middle-class individuals, who are typically the very people tokenization could benefit the most. Without regulatory reform that expands access to tokenized securities for non-accredited investors, much of middle America remains shut out of these new opportunities. Ultimately, achieving a balance in regulation will be key to tokenization’s potential to open up wealth-building opportunities for all.