Imagine owning a piece of a Manhattan skyscraper or holding a share in a Picasso painting—all with just a few clicks.

It sounds like a scene from the future, but it’s happening right now, thanks to blockchain technology.

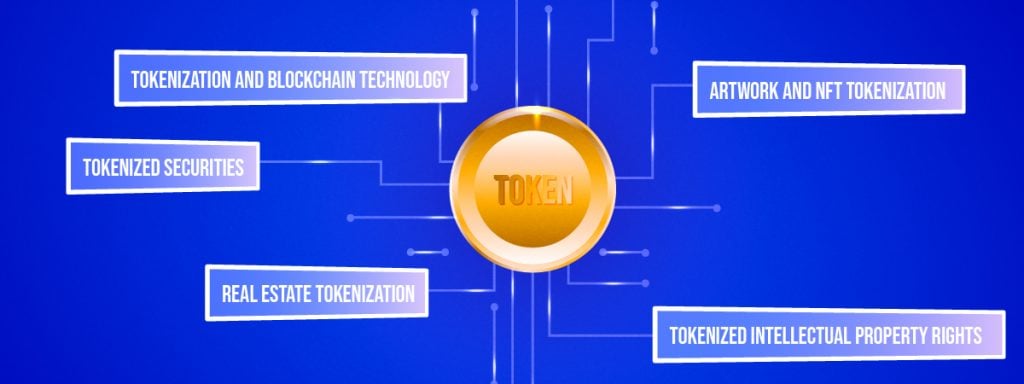

Tokenization is revolutionizing how we think about ownership by transforming real-world assets into digital tokens that anyone can own, buy, sell, or trade.

From real estate to fine art, this shift is breaking down traditional barriers and creating exciting new opportunities for investors of all sizes.

What is Tokenization?

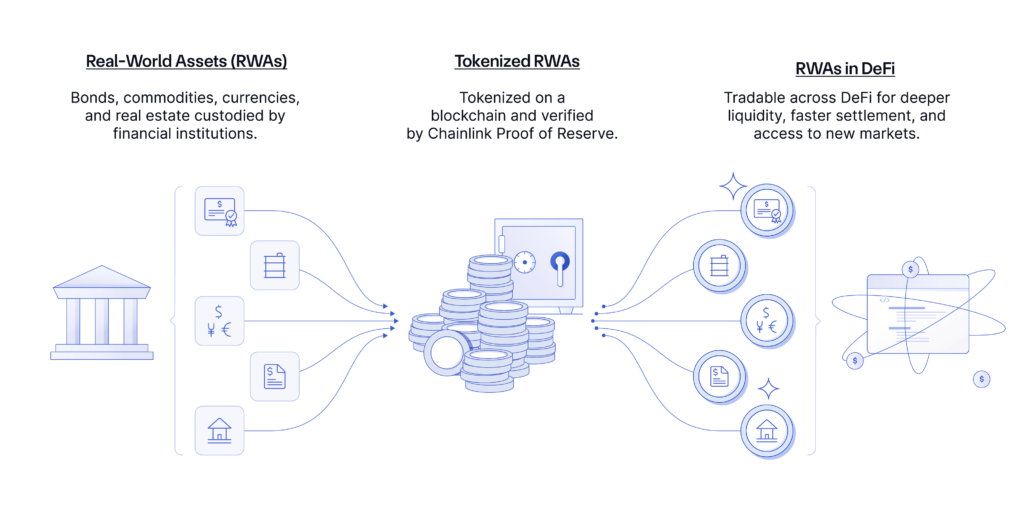

Tokenization takes the ownership of a real-world asset—like a building, a painting, or even stocks—and turns it into digital tokens on a blockchain. These tokens represent fractional ownership of the asset, allowing investors to buy small shares rather than needing millions to own the whole thing.

Once tokenized, assets can be traded on blockchain platforms, giving investors more flexibility and liquidity than traditional markets.

Imagine having a slice of an apartment building in New York, collecting rental income, enjoying investment real estate tax breaks, and being able to sell your share at any time without the hassle of middlemen.

That’s the power of tokenization.

Why Tokenization Matters

Tokenization isn’t just a technical innovation—it’s a game changer for access, liquidity, and transparency in investment markets.

Traditionally, high-value assets like real estate or fine art were reserved for the ultra-wealthy, locked behind massive price tags and long holding periods.

Tokenization flips the script by opening the door to fractional ownership.

No longer do you need millions to invest in high-value assets. Instead, you can own a fraction, spreading your investments across multiple assets and asset classes, from commercial buildings to rare art pieces.

Even better, tokenized assets can be traded 24/7 on decentralized exchanges, bringing liquidity to traditionally illiquid markets.

With no intermediaries involved, transaction costs plummet, and the speed of buying and selling skyrockets. Blockchain’s transparency also ensures every transaction is visible, reducing fraud and disputes over ownership.

In short, tokenization is the great equalizer—democratizing access to wealth.

Disrupting Traditional Markets

Tokenization doesn’t just give power to the people; it disrupts the entire system.

By cutting out traditional gatekeepers like banks, brokers, and real estate firms, tokenization offers a direct, peer-to-peer marketplace that reduces fees, increases transparency, and speeds up transactions.

In traditional real estate, for example, buying property is a nightmare of paperwork, agents, lawyers, and months of waiting. Tokenized real estate turns that process into a few clicks, allowing you to buy, trade, or sell your fractional ownership in real-time.

The same goes for other markets like fine art or stocks, where tokenization is smashing down the barriers that kept ordinary people out.

When you tokenize an asset, you also remove the need for middlemen like escrow services and legal custodians.

Blockchain’s smart contracts take care of all that—automatically executing transactions when conditions are met, securely and without the need for trust between parties.

We’re not just talking about a minor improvement. This is a seismic shift in how value is stored and transferred across every asset class.

Tokenization in Action

1. Tokenized Real Estate

Let’s say you want to own a slice of a Miami beachside property but don’t have a million dollars lying around. Platforms like RealT allow you to invest in tokenized real estate, where you can buy fractional shares of properties. As a token holder, you’re entitled to a percentage of rental income, and you can sell your shares whenever you want—without a realtor, lawyer, or months of waiting.

2. Tokenized Art

Art has always been an investment vehicle for the rich, but tokenized art is changing that. Platforms like Maecenas enable investors to buy fractions of valuable artworks. Instead of needing $10 million to buy an entire painting, you can own a fraction of a Banksy or a Van Gogh for as little as $100. Not only does this bring fine art to the masses, but it also creates a secondary market for trading these art tokens.

3. Tokenized Stocks

You’ve heard of the stock market, but what about a tokenized version of it? Platforms like Mirror Protocol are pioneering tokenized stocks, allowing you to invest in synthetic assets that mirror the price movements of real stocks. Now, anyone with an internet connection can access these markets, breaking down barriers to stock market investment for people in emerging economies or those without access to traditional exchanges.

Challenges and Risks

Of course, it’s not all sunshine and rainbows.

Tokenization faces some challenges, particularly around regulation.

Right now, the legal framework for tokenized assets is still evolving, and different countries are taking different approaches. Some view tokenized assets as securities, subject to strict regulation, while others are more lenient.

Market volatility is another concern.

Because tokenized assets exist at the intersection of traditional and crypto markets, they can be affected by the ups and downs of both. You might be exposed to the volatility of the crypto space, which can be intense, especially for new or speculative investors.

Finally, platform security is key.

While blockchain is inherently secure, smart contracts can have vulnerabilities, and hacks on decentralized platforms have occurred. Investors must do their due diligence when choosing where to trade tokenized assets.

How to Get Involved

If you’re ready to dip your toes into the world of tokenized assets, the first step is research. Understand the platform, the asset, and the regulatory landscape. Ensure the platform is reputable and has security measures in place.

Emerging platforms like Securitize, RealT, and OpenSea are leading the way in tokenized real estate, stocks, and art. These platforms allow you to purchase fractional shares, hold tokens, and trade them on secondary markets. For example, Securitize specializes in issuing compliant tokenized securities, while OpenSea has become a hub for all kinds of tokenized real world assets.

For retail investors, tokenized assets offer a new way to diversify portfolios.

You can spread your risk across various assets and even asset classes, from a fraction of a Picasso to a share in a New York office building. As with any investment, a diversified strategy can help smooth out the risks.

Final Thoughts

Tokenization is not just a fad. It’s a revolution in how we own, invest in, and transfer real-world assets. Blockchain technology is democratizing wealth by making previously untouchable markets—like real estate, art, and even stocks—accessible to everyone.

As this movement grows, the opportunities for investors are bound to multiply.

The playing field is leveling, and those who understand this technology now are poised to ride the wave into a new era of financial freedom.

The tokenization revolution is here. Are you ready to own a piece of the future?